Cogno AI Chatbot - Intelligent Customer Support

Built an industry-specific chatbot experience to handle complex financial interactions while ensuring compliance, trust, and ease of use.

Achieved 85% intent recognition accuracy with multilingual support for complex query handling.

OVERVIEW

India’s BFSI sector serves millions of customers daily, and with the surge in digital adoption, users now expect instant, secure, and intelligent support experiences—without long waits or repeated calls. Recognizing this shift, one of India’s top banks set out to reimagine its customer support through a conversational AI chatbot.

As the solo designer, I was tasked with building a chatbot experience that could handle complex financial workflows—from balance checks and loan inquiries to credit card blocking—while maintaining the clarity, trust, and empathy essential to financial communication.

UI UX Designer 1 | Exotel

User Research, Interactions, Visual Design, Prototyping and User Testing

March 2-23 - September 2024

THE PROBLEM

The challenge wasn’t just technical—it was human. Previous bots had failed to understand context, often frustrating users and leading to abrupt escalations. Our goal was to design a smart, self-service AI assistant that not only solved problems but felt approachable, secure, and human when needed.

This project aimed to automate high-volume queries, reduce the load on support teams, and bring confidence back into digital banking conversations—all while meeting strict legal and compliance standards.

USER RESEARCH

To design a context-aware chatbot for one of India’s top banks, we conducted extensive user research with key stakeholders including customer service agents, product managers, compliance officers, and actual banking customers across multiple regions.

Our research focused on understanding:

- The types of customer queries handled by support teams

- Frequency and complexity of financial tasks (e.g., loan inquiries, card blocking)

- Breakpoints in existing support channels, including IVR and legacy chatbots

- Emotional and behavioral patterns during stressful or high-stakes conversations

- Compliance and security requirements at each step of the interaction

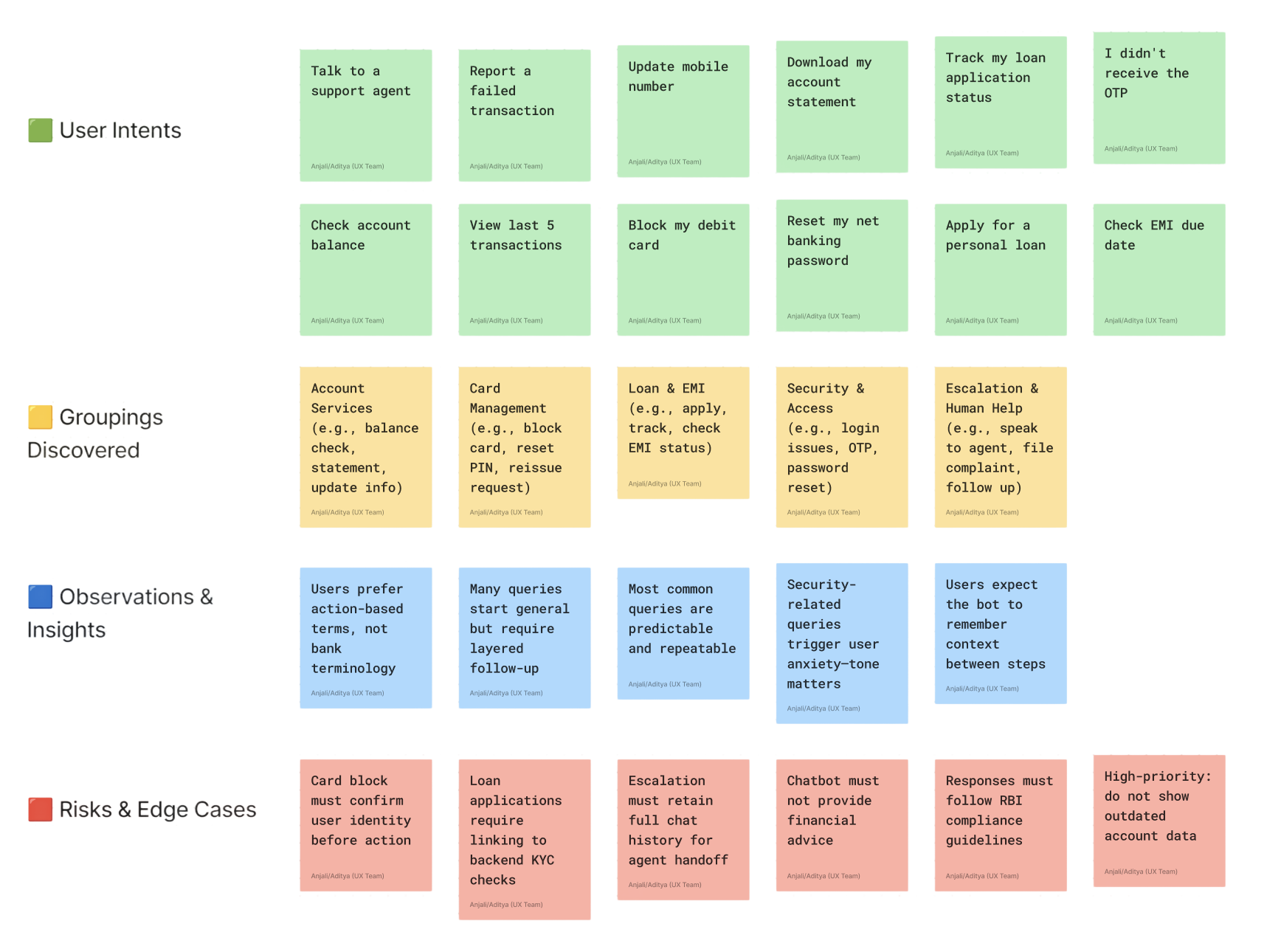

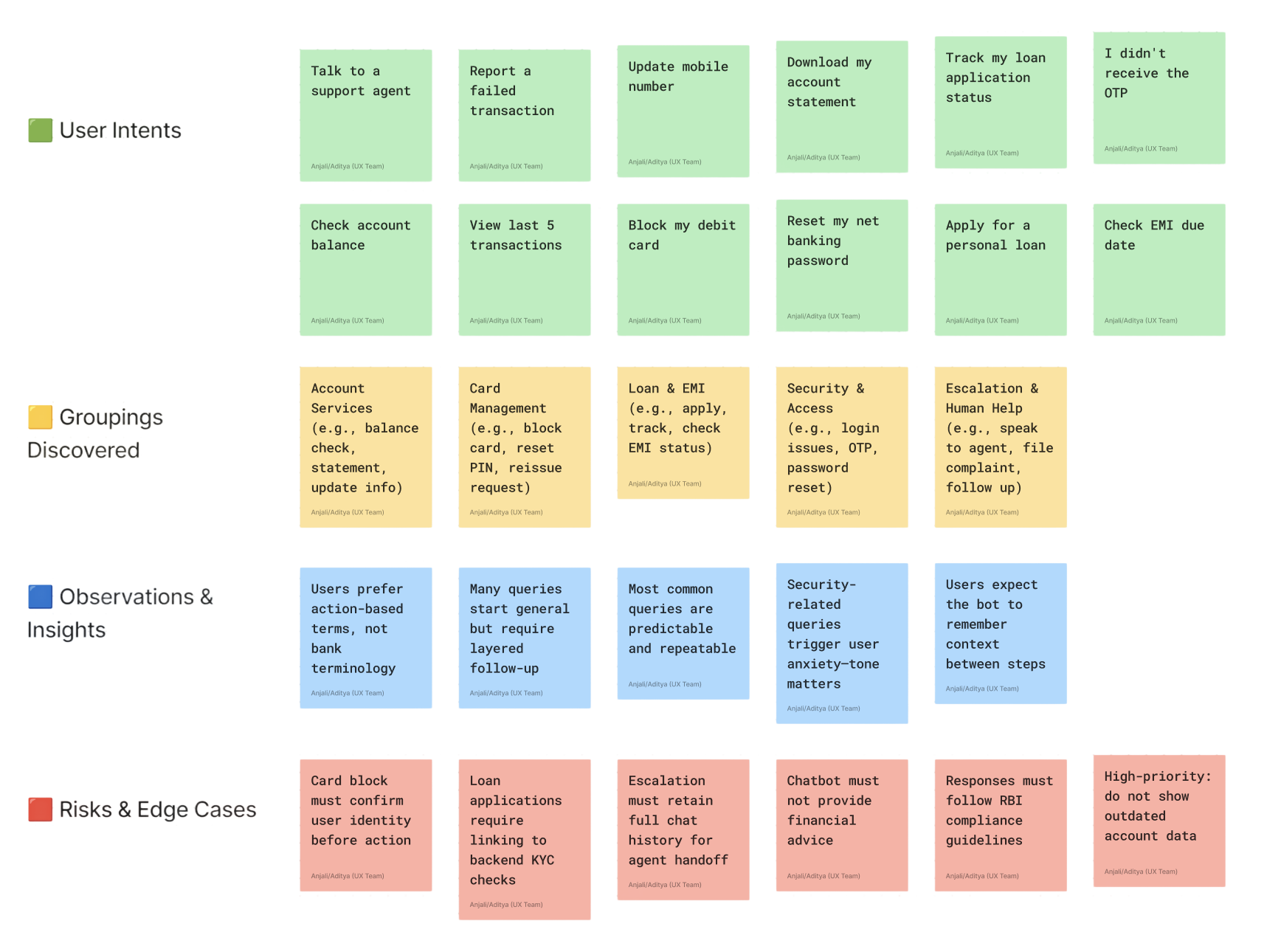

Fig: Picture from the workshop conducted to understand the hierarchy and card sorting exercise to come up with the product IA

Quantitative Interviews

Understanding the unique workflows and customer support challenges across major banks was essential to shaping a conversational AI solution that truly fits real needs. We conducted in-depth interviews with employees at multiple levels from Axis Bank, ICICI Bank, and State Bank of India (SBI).

These interviews helped us uncover gaps in current support systems, pain points in handling customer queries, and opportunities for automation via intelligent chatbots.

We receive hundreds of balance check and card block requests daily. The current chatbot often loops back or misunderstands context. Agents end up intervening too often, creating unnecessary load.

Customer Support Lead, Axis Bank

Our IVR deflects users to chat, but we see drop-offs when the chatbot can't understand follow-up questions. There's a trust gap, especially with sensitive requests like PIN resets or failed transactions.

Service Manager, SBI

Handling loan-related queries is still very manual. Customers want real-time answers, but the bot can't handle multi-step processes like application tracking or eligibility checks smoothly.

Product Manager, ICICI Bank

Key Insights

Through our comprehensive research and interviews, we uncovered critical insights that shaped our design approach and informed our strategy for creating a truly effective AI-powered customer support solution.

Context Loss is the Primary Pain Point

Users repeatedly expressed frustration when chatbots failed to understand follow-up questions or remember previous interactions, forcing them to restart conversations.

High-Volume Queries Need Instant Resolution

85% of customer queries involve routine tasks like balance checks, transaction history, and account updates that could be automated with proper design.

Trust is Built Through Transparency

Customers want clear communication about what the AI can and cannot do, with obvious paths to human agents when needed.

Security Concerns Drive User Behavior

Users hesitate to share sensitive information with chatbots, requiring careful design of authentication flows and security messaging.

Design Process

01

Research & Discovery

Conducted user interviews with bank customers and support agents to understand pain points and opportunities.

02

Problem Definition

Identified key challenges in current support systems and defined success metrics for the AI solution.

03

Design & Prototype

Created conversational flows, designed the interface, and built interactive prototypes for testing.

04

Test & Iterate

Conducted usability testing, gathered feedback, and refined the design based on user insights.

Key Features

Natural Language Processing

Advanced NLP capabilities that understand customer intent and context, enabling more accurate and helpful responses.

- Intent recognition

- Context awareness

- Multi-language support

Smart Escalation

Intelligent routing system that seamlessly transfers complex queries to human agents with full context.

- Automatic escalation triggers

- Context preservation

- Agent handoff protocols

Financial Compliance

Built-in security and compliance features specifically designed for banking and financial services.

- Data encryption

- Audit trails

- Regulatory compliance

Analytics Dashboard

Comprehensive analytics and reporting to track performance, identify trends, and optimize the chatbot.

- Performance metrics

- User satisfaction tracking

- Conversation analytics

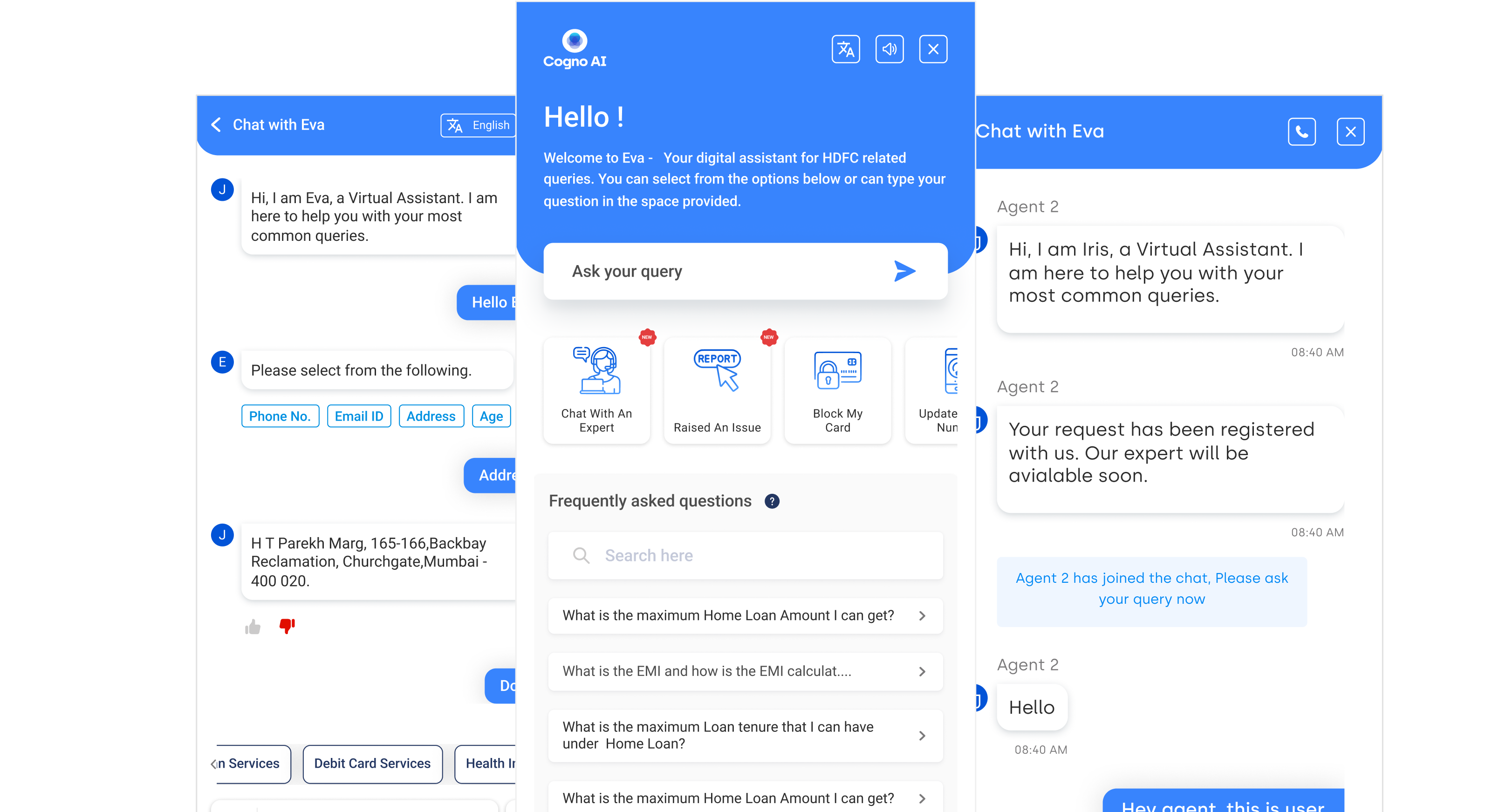

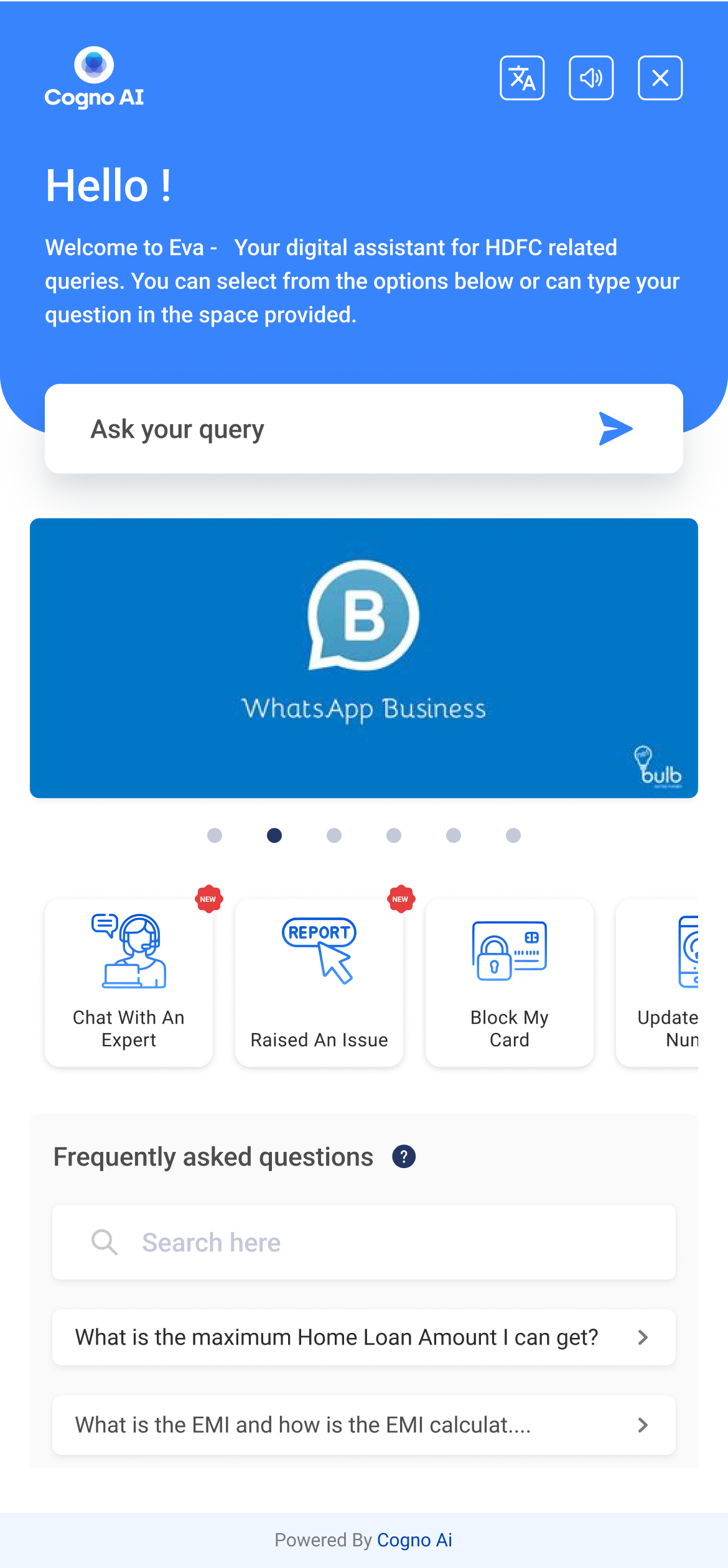

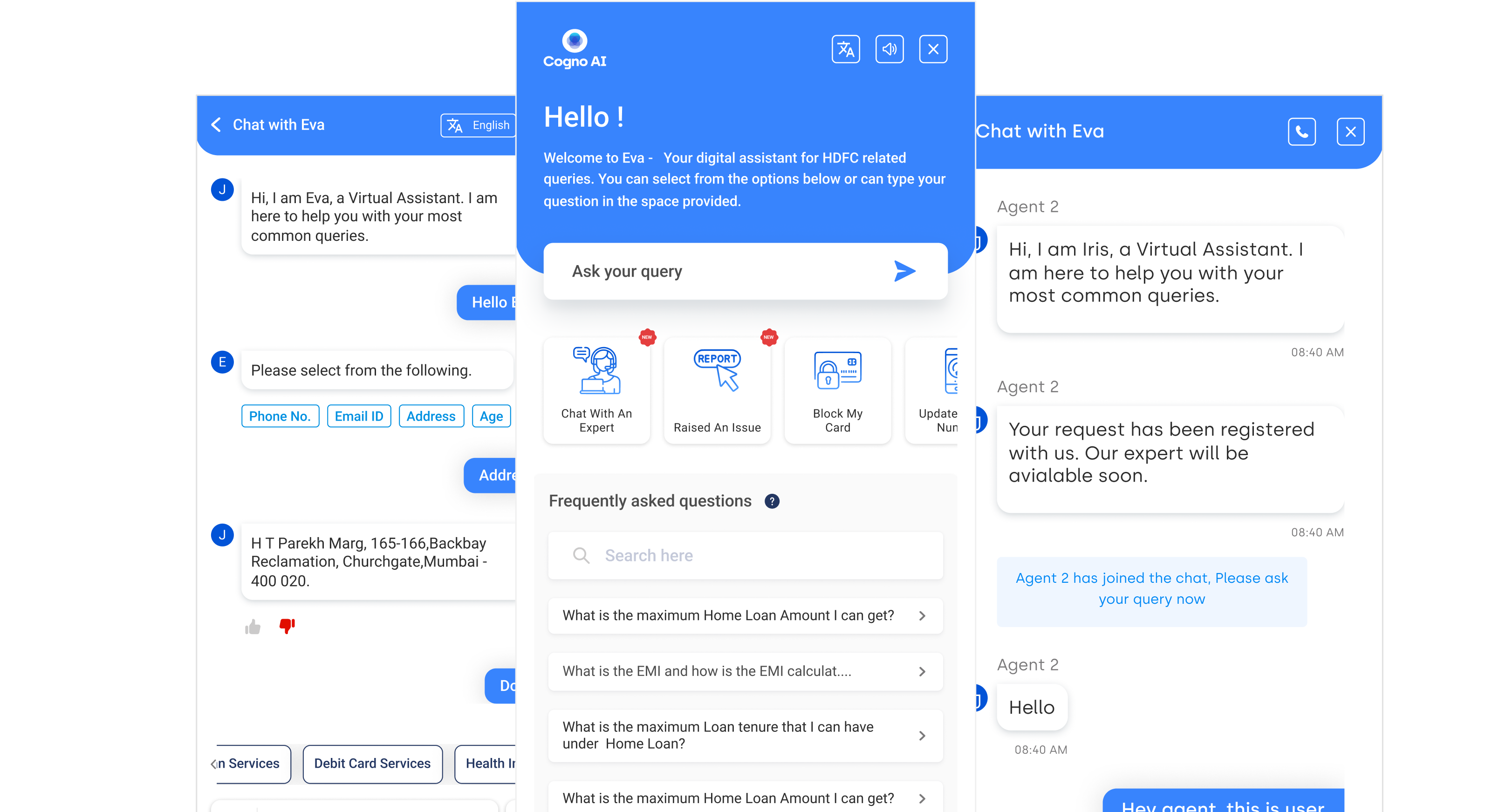

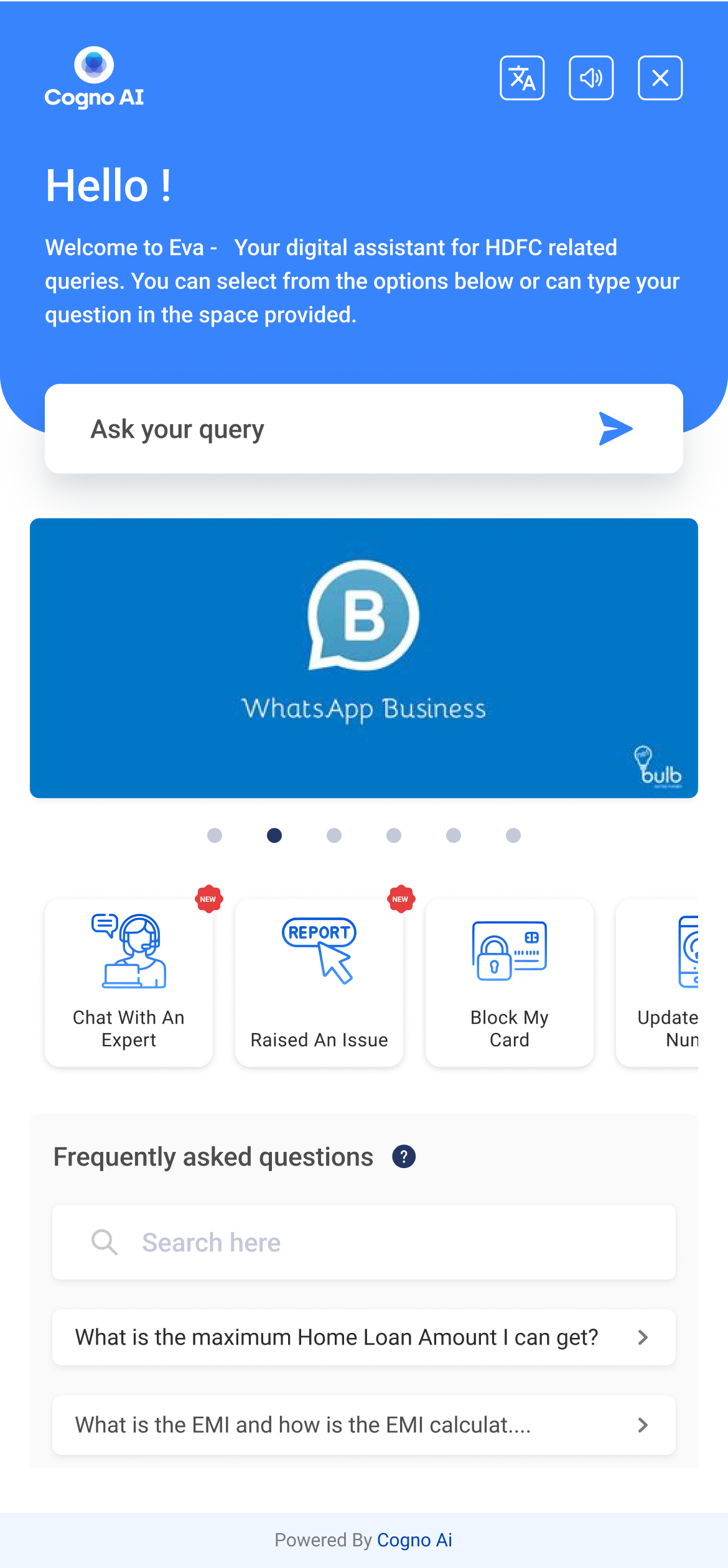

Eva: The Complete Experience

The final Eva interface represents a comprehensive solution that bridges the gap between automated assistance and human support, delivering a seamless experience for HDFC customers across multiple touchpoints.

- Intelligent Welcome Flow: Personalized greeting with contextual quick actions based on user behavior and common banking needs.

- Multi-Channel Integration: Seamless transition between WhatsApp Business and web interface while maintaining conversation context.

- Proactive Support: Smart FAQ suggestions and search functionality that anticipates user questions before they're asked.

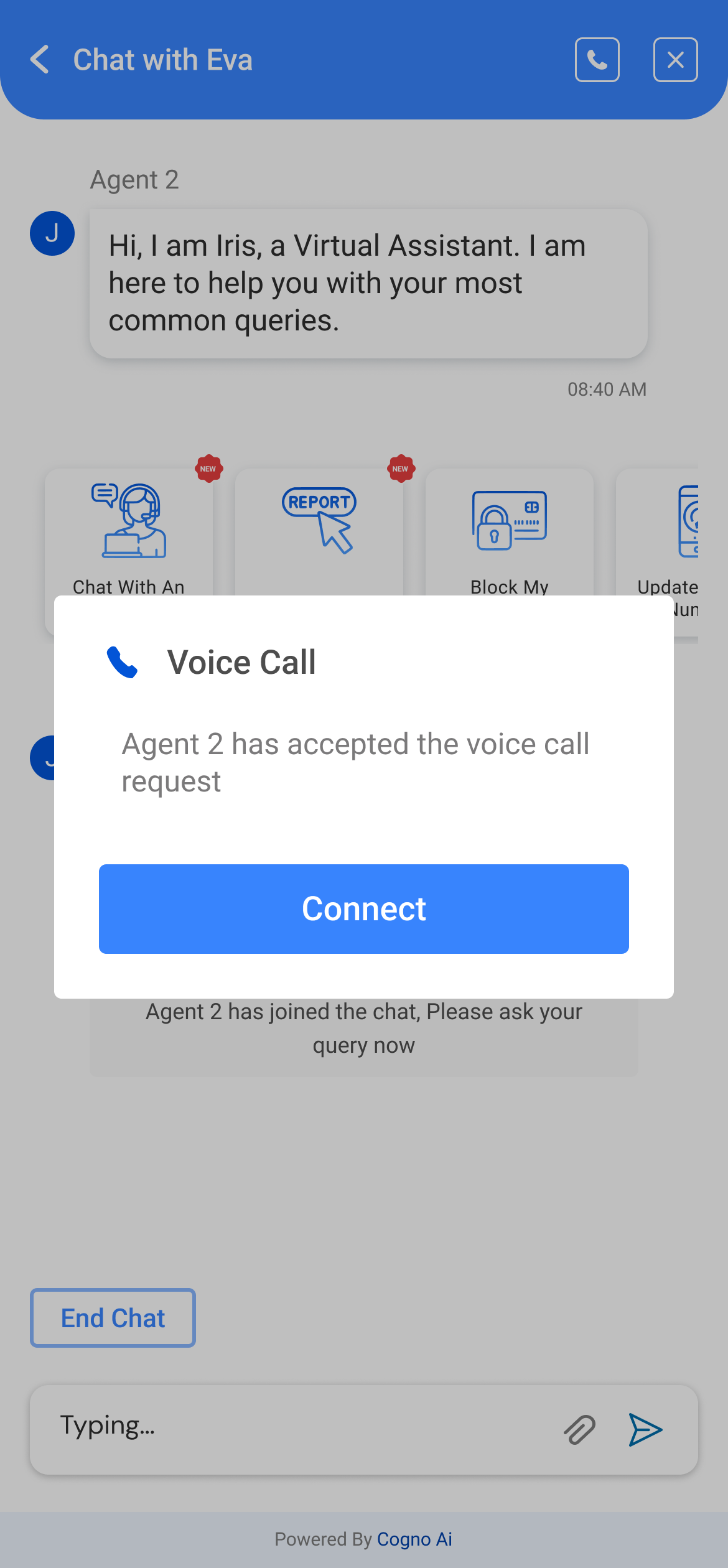

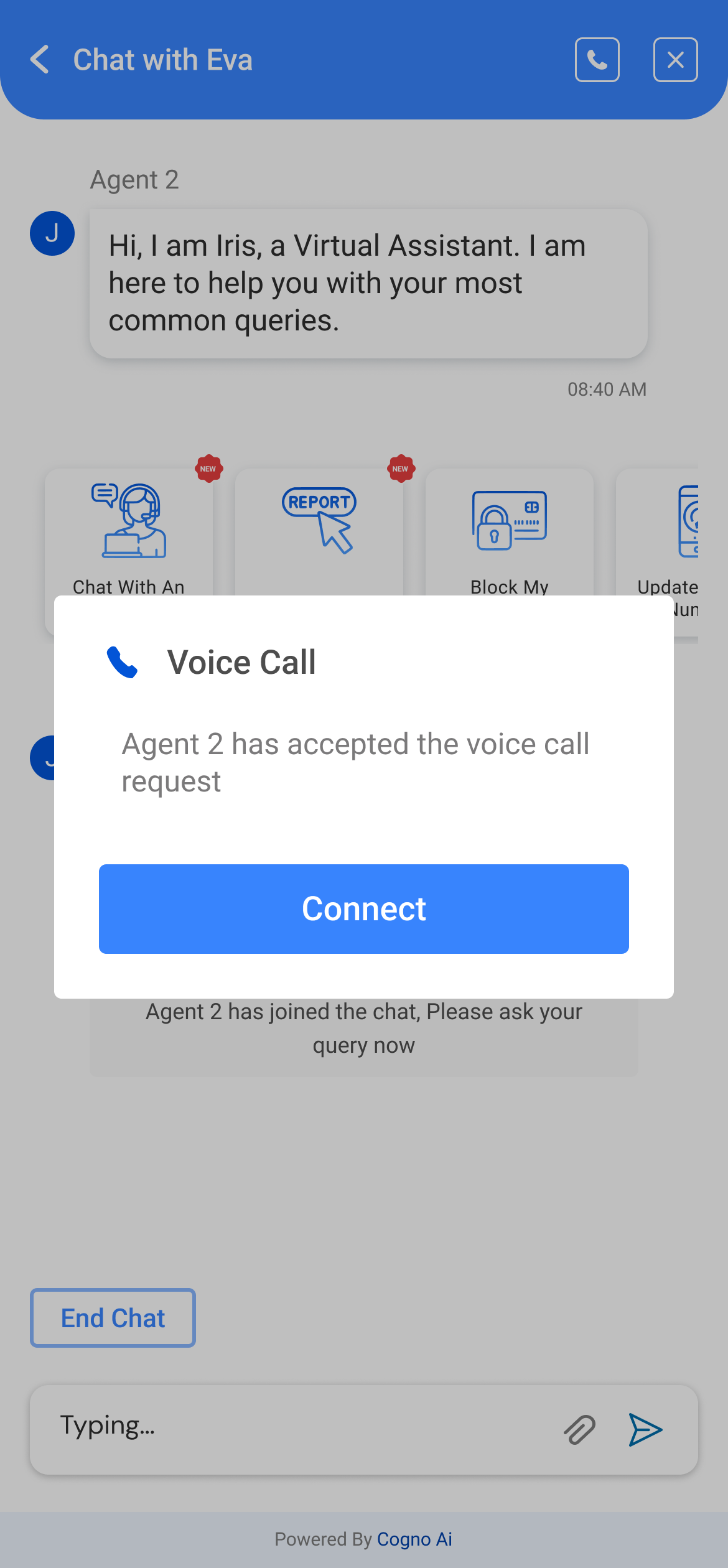

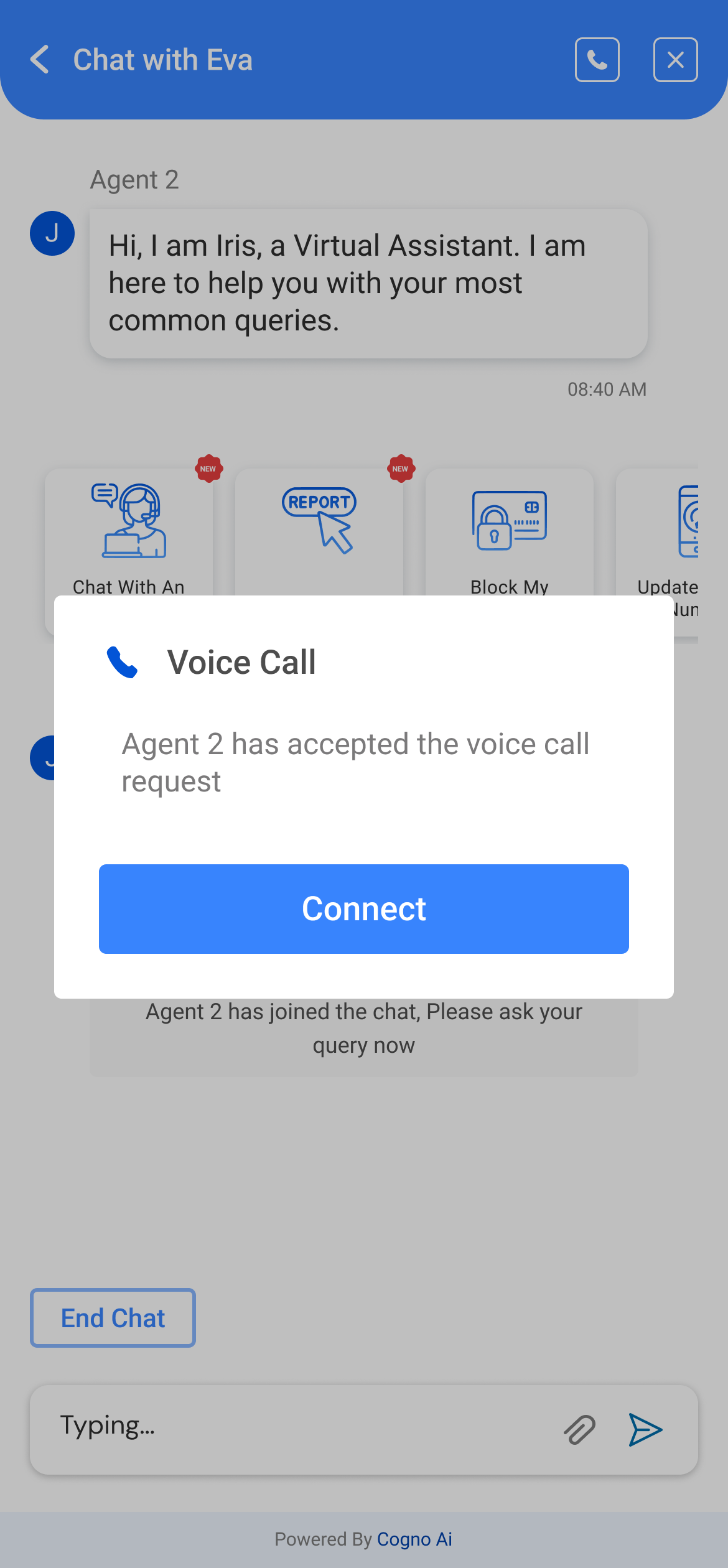

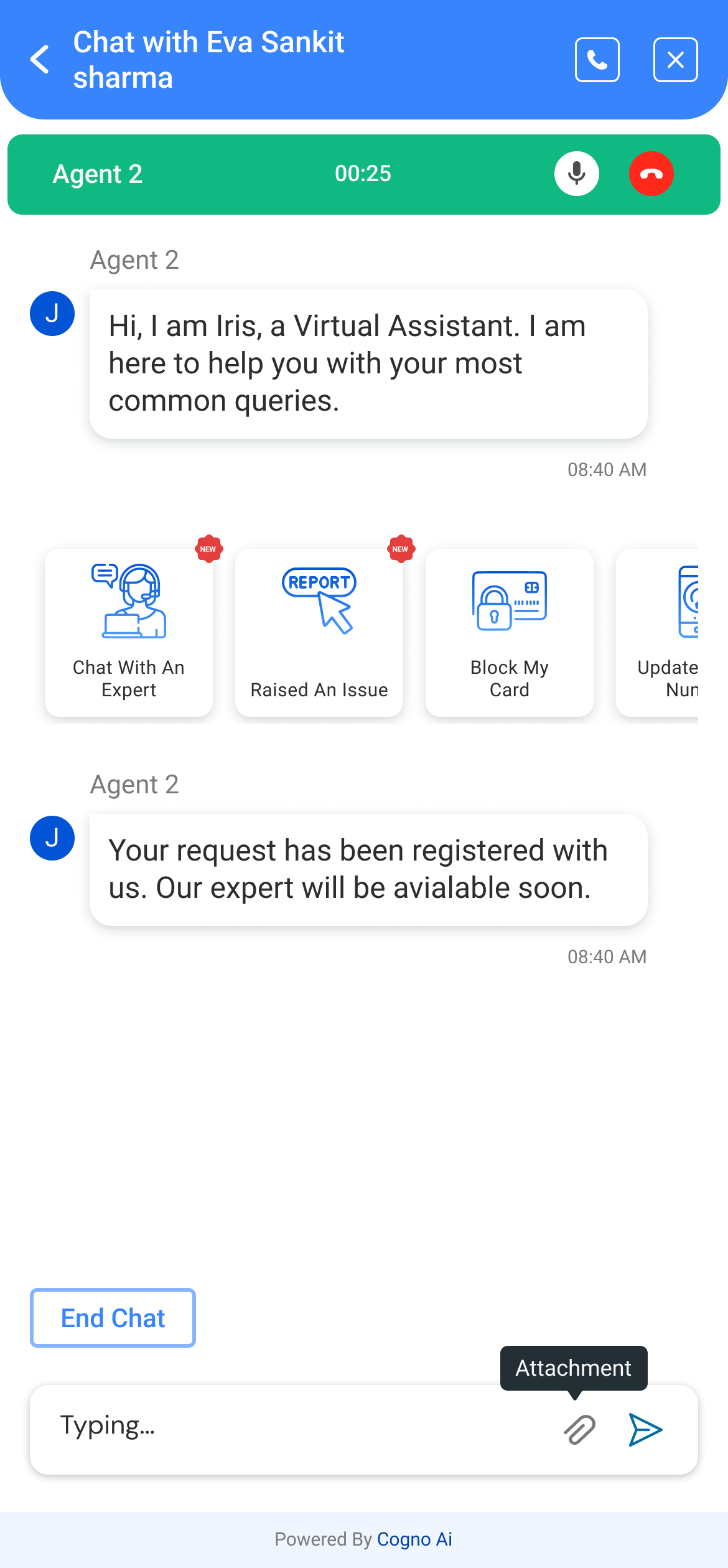

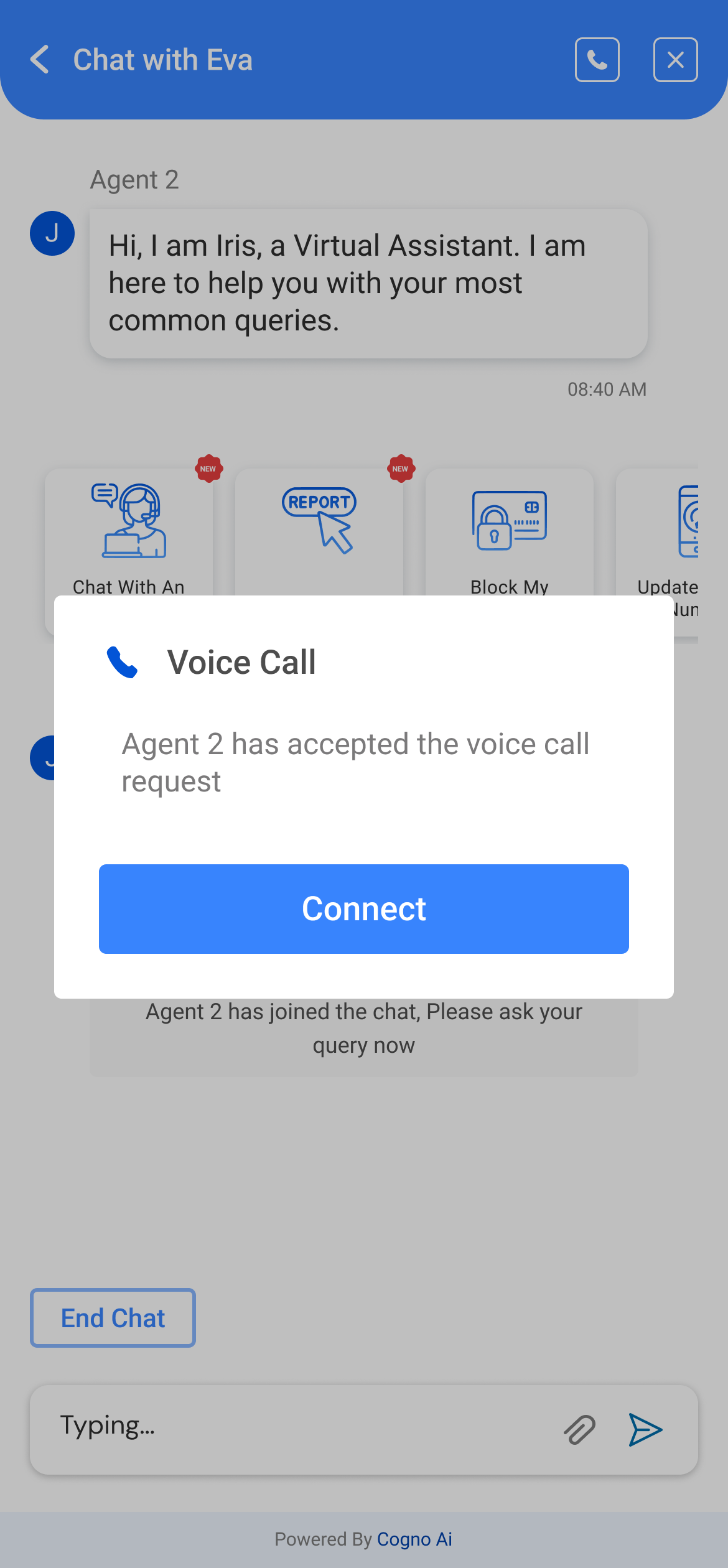

Seamless Voice Call Integration

Eva's voice call feature bridges the gap between digital convenience and human connection. When complex issues require detailed discussion, customers can instantly connect with live agents while preserving complete conversation context.

- Instant Voice Connection: One-tap access to live agents with immediate call acceptance notifications and transparent wait times.

- Context Preservation: Complete chat history and customer data automatically shared with agents for informed conversations.

- Multi-Modal Support: Seamless switching between chat, voice, and quick actions for optimal customer experience.

Multilingual Support & Feedback Integration

Eva's intelligent interface breaks language barriers with comprehensive multilingual support for Indian customers, while seamlessly integrating feedback collection to continuously improve the user experience and service quality.

- Native Language Support: Dynamic language switching supporting Hindi, Tamil, Bengali, Malayalam, and other regional languages for authentic customer interactions.

- Comprehensive Feedback System: Multi-dimensional feedback collection covering communication ease, satisfaction levels, response quality, and overall experience metrics.

- Contextual Assessment: Smart feedback prompts that appear at optimal moments in the conversation flow, ensuring high response rates and meaningful insights.

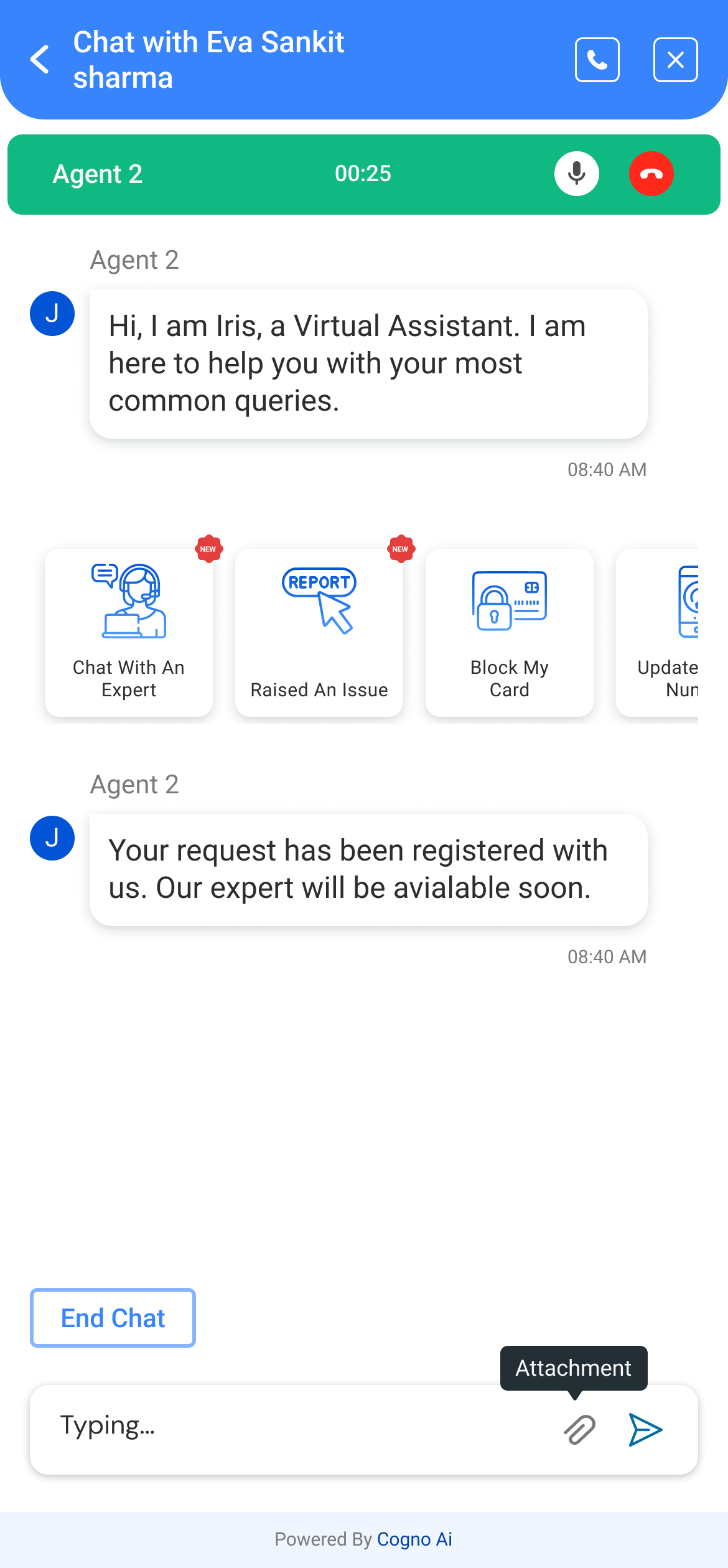

Mobile-First Conversation Design

Our mobile interface prioritizes accessibility and ease of use, ensuring customers can access support seamlessly across all devices. The design maintains conversation context while providing quick action buttons for common banking tasks.

- Seamless Agent Handoff: Smooth transition from AI to human agents when complex issues require personal attention.

- Quick Action Interface: One-tap access to frequently requested services like reporting issues, card blocking, and account inquiries.

- Real-time Status Updates: Live indicators showing agent availability and response times for transparent communication.

Ready to explore more work?

This project showcases how thoughtful design can transform complex financial interactions into seamless customer experiences.

View all Projects

Next Project

2025

Anjali Shrivastava.

All rights reserved.

Cogno AI Chatbot - Intelligent Customer Support

Built an industry-specific chatbot experience to handle complex financial interactions while ensuring compliance, trust, and ease of use.

Achieved 85% intent recognition accuracy with multilingual support for complex query handling.

OVERVIEW

India’s BFSI sector serves millions of customers daily, and with the surge in digital adoption, users now expect instant, secure, and intelligent support experiences—without long waits or repeated calls. Recognizing this shift, one of India’s top banks set out to reimagine its customer support through a conversational AI chatbot.

As the solo designer, I was tasked with building a chatbot experience that could handle complex financial workflows—from balance checks and loan inquiries to credit card blocking—while maintaining the clarity, trust, and empathy essential to financial communication.

UI UX Designer 1 | Exotel

User Research, Interactions, Visual Design, Prototyping and User Testing

March 2-23 - September 2024

THE PROBLEM

The challenge wasn’t just technical—it was human. Previous bots had failed to understand context, often frustrating users and leading to abrupt escalations. Our goal was to design a smart, self-service AI assistant that not only solved problems but felt approachable, secure, and human when needed.

This project aimed to automate high-volume queries, reduce the load on support teams, and bring confidence back into digital banking conversations—all while meeting strict legal and compliance standards.

USER RESEARCH

To design a context-aware chatbot for one of India’s top banks, we conducted extensive user research with key stakeholders including customer service agents, product managers, compliance officers, and actual banking customers across multiple regions.

Our research focused on understanding:

- The types of customer queries handled by support teams

- Frequency and complexity of financial tasks (e.g., loan inquiries, card blocking)

- Breakpoints in existing support channels, including IVR and legacy chatbots

- Emotional and behavioral patterns during stressful or high-stakes conversations

- Compliance and security requirements at each step of the interaction

Fig: Picture from the workshop conducted to understand the hierarchy and card sorting exercise to come up with the product IA

Quantitative Interviews

Understanding the unique workflows and customer support challenges across major banks was essential to shaping a conversational AI solution that truly fits real needs. We conducted in-depth interviews with employees at multiple levels from Axis Bank, ICICI Bank, and State Bank of India (SBI).

These interviews helped us uncover gaps in current support systems, pain points in handling customer queries, and opportunities for automation via intelligent chatbots.

We receive hundreds of balance check and card block requests daily. The current chatbot often loops back or misunderstands context. Agents end up intervening too often, creating unnecessary load.

Customer Support Lead, Axis Bank

Our IVR deflects users to chat, but we see drop-offs when the chatbot can't understand follow-up questions. There's a trust gap, especially with sensitive requests like PIN resets or failed transactions.

Service Manager, SBI

Handling loan-related queries is still very manual. Customers want real-time answers, but the bot can't handle multi-step processes like application tracking or eligibility checks smoothly.

Product Manager, ICICI Bank

Key Insights

Through our comprehensive research and interviews, we uncovered critical insights that shaped our design approach and informed our strategy for creating a truly effective AI-powered customer support solution.

Context Loss is the Primary Pain Point

Users repeatedly expressed frustration when chatbots failed to understand follow-up questions or remember previous interactions, forcing them to restart conversations.

High-Volume Queries Need Instant Resolution

85% of customer queries involve routine tasks like balance checks, transaction history, and account updates that could be automated with proper design.

Trust is Built Through Transparency

Customers want clear communication about what the AI can and cannot do, with obvious paths to human agents when needed.

Security Concerns Drive User Behavior

Users hesitate to share sensitive information with chatbots, requiring careful design of authentication flows and security messaging.

Design Process

01

Research & Discovery

Conducted user interviews with bank customers and support agents to understand pain points and opportunities.

02

Problem Definition

Identified key challenges in current support systems and defined success metrics for the AI solution.

03

Design & Prototype

Created conversational flows, designed the interface, and built interactive prototypes for testing.

04

Test & Iterate

Conducted usability testing, gathered feedback, and refined the design based on user insights.

Key Features

Natural Language Processing

Advanced NLP capabilities that understand customer intent and context, enabling more accurate and helpful responses.

- Intent recognition

- Context awareness

- Multi-language support

Smart Escalation

Intelligent routing system that seamlessly transfers complex queries to human agents with full context.

- Automatic escalation triggers

- Context preservation

- Agent handoff protocols

Financial Compliance

Built-in security and compliance features specifically designed for banking and financial services.

- Data encryption

- Audit trails

- Regulatory compliance

Analytics Dashboard

Comprehensive analytics and reporting to track performance, identify trends, and optimize the chatbot.

- Performance metrics

- User satisfaction tracking

- Conversation analytics

Eva: The Complete Experience

The final Eva interface represents a comprehensive solution that bridges the gap between automated assistance and human support, delivering a seamless experience for HDFC customers across multiple touchpoints.

- Intelligent Welcome Flow: Personalized greeting with contextual quick actions based on user behavior and common banking needs.

- Multi-Channel Integration: Seamless transition between WhatsApp Business and web interface while maintaining conversation context.

- Proactive Support: Smart FAQ suggestions and search functionality that anticipates user questions before they're asked.

Seamless Voice Call Integration

Eva's voice call feature bridges the gap between digital convenience and human connection. When complex issues require detailed discussion, customers can instantly connect with live agents while preserving complete conversation context.

- Instant Voice Connection: One-tap access to live agents with immediate call acceptance notifications and transparent wait times.

- Context Preservation: Complete chat history and customer data automatically shared with agents for informed conversations.

- Multi-Modal Support: Seamless switching between chat, voice, and quick actions for optimal customer experience.

Multilingual Support & Feedback Integration

Eva's intelligent interface breaks language barriers with comprehensive multilingual support for Indian customers, while seamlessly integrating feedback collection to continuously improve the user experience and service quality.

- Native Language Support: Dynamic language switching supporting Hindi, Tamil, Bengali, Malayalam, and other regional languages for authentic customer interactions.

- Comprehensive Feedback System: Multi-dimensional feedback collection covering communication ease, satisfaction levels, response quality, and overall experience metrics.

- Contextual Assessment: Smart feedback prompts that appear at optimal moments in the conversation flow, ensuring high response rates and meaningful insights.

Mobile-First Conversation Design

Our mobile interface prioritizes accessibility and ease of use, ensuring customers can access support seamlessly across all devices. The design maintains conversation context while providing quick action buttons for common banking tasks.

- Seamless Agent Handoff: Smooth transition from AI to human agents when complex issues require personal attention.

- Quick Action Interface: One-tap access to frequently requested services like reporting issues, card blocking, and account inquiries.

- Real-time Status Updates: Live indicators showing agent availability and response times for transparent communication.

Ready to explore more work?

This project showcases how thoughtful design can transform complex financial interactions into seamless customer experiences.

View all Projects

Next Project

2025

Anjali Shrivastava.

All rights reserved.